National rates are calculated based on a simple average of rates paid (uses annual percentage yield) by all insured depository institutions and branches for which data are available. See Deposit Account Agreement (PDF) for terms and conditions. The average national savings account interest rate of 0.42% is determined by the FDIC as of 7/17/23. APY may change before or after you open an account. * * Interest paid quarterly on the average daily balance of savings during the quarter up to a $5,000 balance and if the account is in good standing. Fees on your primary deposit account may reduce earnings on your savings account. 4.50% Annual Percentage Yield (APY) as of August 2023. High-yield savings account, 4.50% APY paid quarterly on savings up to $5,000.

Learn more (Overdraft Protection PDF).Īpply or opt in after eligible direct depositsĮarn over 10x the national savings rate average Balance must be brought to at least $0 within 24 hours of authorization of the first transaction that overdraws your account to avoid a fee. A $15 fee may apply to each eligible purchase transaction that brings your account negative. Overdraft fees may cause your account to be overdrawn by an amount that is greater than your overdraft coverage. Additional criteria may apply which can affect your eligibility and your overdraft coverage. Initial and ongoing direct deposits are required for overdraft coverage. Account must be in good standing and chip-enabled debit card activated to opt in. For additional information about Annual Percentage Rates, fees and other costs, see the GO2bank Secured Credit Cardholder Agreement and Security Agreement (PDF). Annual Percentage Rate is 22.99% and is accurate as of. Cardholder income will be used as a factor to determine eligibility for a credit limit increase.With no annual fee * * GO2bank Secured Visa Credit Card available only to GO2bank accountholders with direct deposits totaling at least $100 in the past 30 days.

Existing cardholders should see their cardholder agreements for their applicable terms.ĤCardholders may be required to provide their annual net income if their recent information is not on file. Subject to credit approval.ģFor new accounts: Purchase APR is 29.99% Minimum Interest Charge is $2. Existing cardholders: See your credit card agreement terms. For new accounts: Purchase APR is 29.99% Minimum Interest Charge is $2. Regular account terms apply to non-promo purchases and, after promo period ends, to the promo balance. The required minimum monthly payments may or may not pay off the promo balance before the end of the promo period, depending on purchase amount, promo length and payment allocation. If you do not, interest will be charged on the promo balance from the purchase date. No interest will be charged on the promo balance if you pay it off, in full, within the promo period. Qualifying purchase amount must be on one receipt.

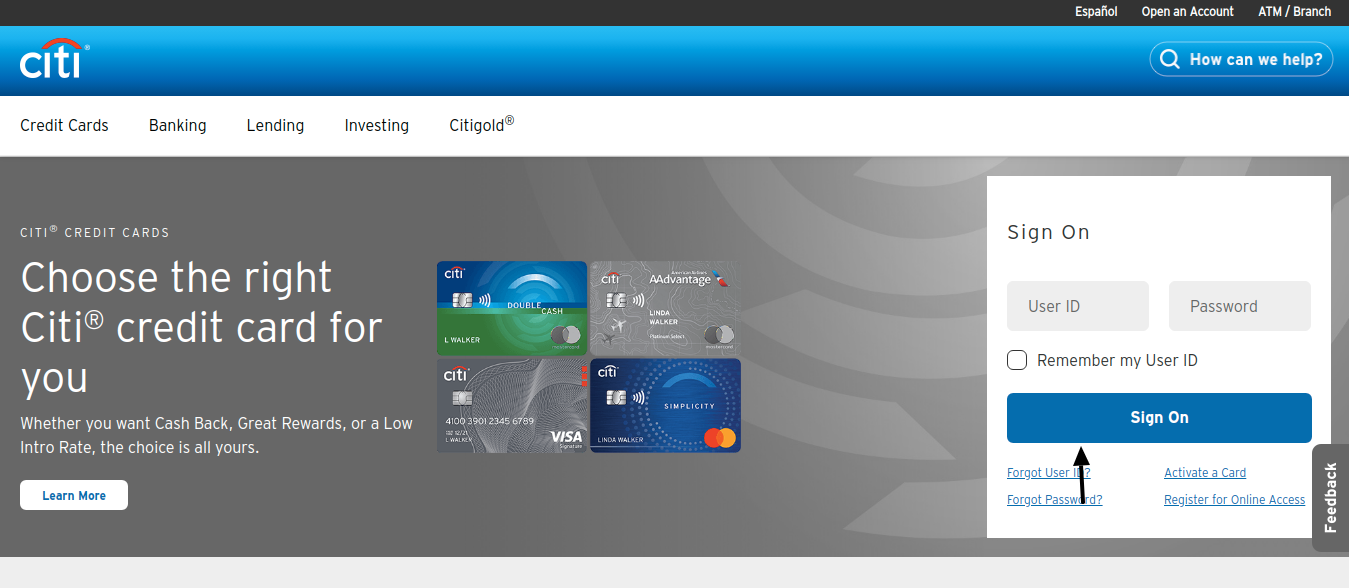

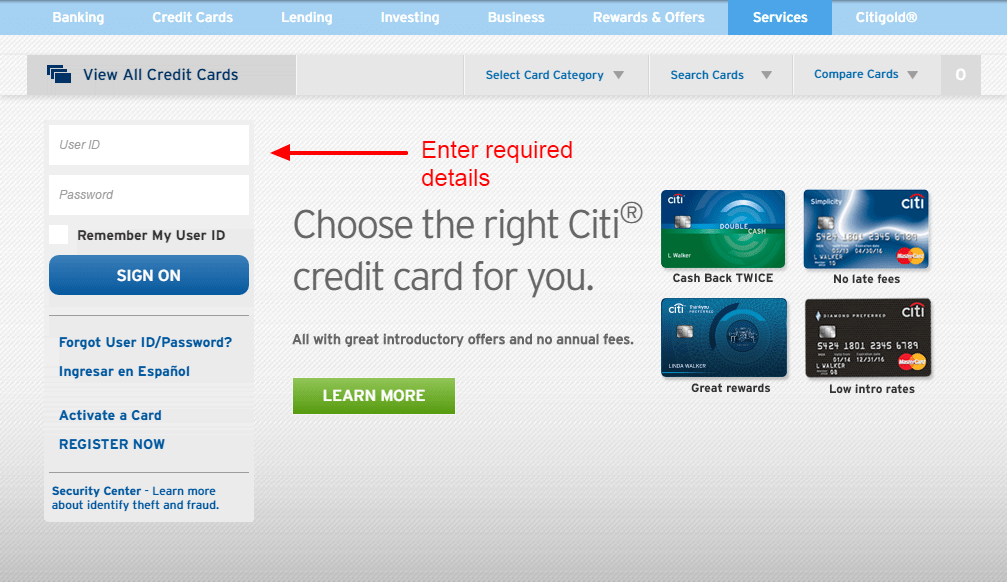

CARD NOW LOGIN FULL

Interest will be charged to your account from the purchase date if the promotional balance is not paid in full within the promotional period. 6 months on purchases of $299 – $1,998.99 or 12 months on purchases of $1,999 or more. See store for details.ĢNo Interest If Paid In Full Within 6 or 12 months on qualifying purchases with your Synchrony HOME Credit Card. Promotional financing offers available at the time of purchase may vary by location. Realize your dream home with help from the Synchrony HOME Credit Card, accepted at thousands of locations nationwide.

0 kommentar(er)

0 kommentar(er)